1. When assessing China’s 2019-2020 economic outlook last November, our key question was whether the economic slowdown in 2018 would be a mid-cycle correction or the start of a prolonged downward trend. We concluded that the medium-term growth trajectory would largely depend on how policies were adjusted both in China and the US. Thus, we chose to present our 2019-2020 macro outlook under three scenarios based on different policy trajectories of the “G2”. Under our base case scenario of 6.4% real GDP growth in 2019, we assumed: 1) notable yet insufficient adjustments of the cyclical management policies in China (mainly fiscal easing that likely begins to occur in 2Q19), 2) 2 interest rate hikes by the Fed in 2019, and 3) partial relief of the US-China trade frictions. We also saw that risks were mostly on the downside for our base case growth forecast.

2. However, after a gloomy quarter of disappointing macro data and market performances at the end of last year at home and globally, Chinese policymakers have taken notable counter cyclical actions earlier and stronger than expected. Strong credit and total social financial growth for January has offered the first positive sign that the world’s second largest economy may be putting an effective “circuit breaker” to halt the slide of its domestic economy. Coupled with a more dovish Fed, as well as relatively positive news flows from the on-going US-China trade negotiations, almost all asset classes globally have seen a strong rebound since the start of this year.

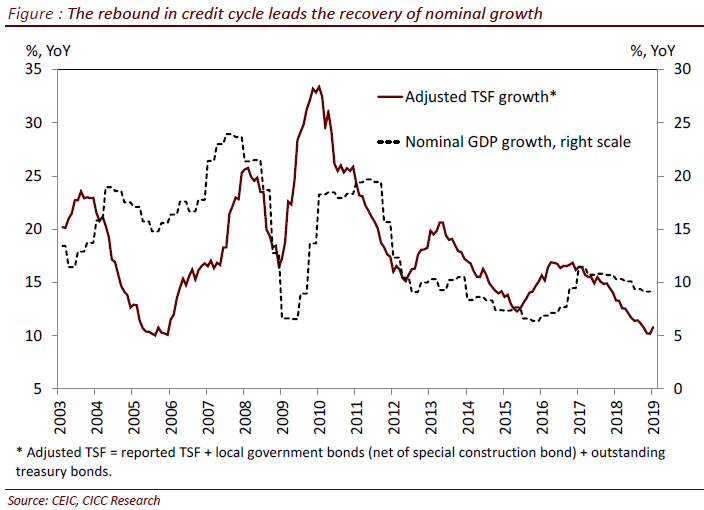

3. Experience shows that if the rebound in credit and total social financing growth is sustained, it will lead to a powerful growth impulse in the Chinese economy, with its reflationary impact felt beyond its borders (Figure 1). The simultaneous easing of financial conditions in the US and China has already resulted in a noticeable rebound in global commodity prices, particularly oil prices. Meanwhile, 10-year Treasury yields seem to also have stopped falling in both markets. Unsurprisingly, the sustainability of China’s credit upsurge should, and will likely, be the focus of global investors in the coming months.

4. We see two related, but also distinct issues in assessing the sustainability of China’s credit expansion. One has to do with its medium-to-long-term efficiency and the other with its durability in the near term. The first issue is important, but evidence will likely be inconclusive for some time. On the other hand, the speed and durability of the credit recovery over the next 3-6 months is more relevant for global risky assets, and it can be observed by investors who can then adjust their macro outlook and asset allocation when facts change.

5. In our view, the earlier and stronger policy responses have revealed that a broad policy consensus may have been reached that: 1) maintaining a healthy pace of growth (still at above 6% level) is important for China; and 2) the severe tightening of financial conditions in 2018 was a policy misstep and needs to be adjusted. Thus, we believe the present growth supporting environment, including an accommodative monetary policy stance, further tax and fee cuts, and lessening of some overly restrictive regulatory requirements, will likely be maintained until signs of growth and/or inflation pickup are confirmed. In other words, the economy is likely to have bottomed, and we now see risks to our growth forecast of 6.4% this year as balanced.

6. On the other hand, the slope and duration of this episode of credit recovery are likely to be more constrained than either the 2008-2009 or the 2016-2017 reflation experiences for three reasons. First, the balance sheets at both banks and government (incl. local governments) are more stretched, and need to be repaired and/or restructured. Second, many regulatory constraints introduced in the last few years, including those on the financial sector, local government financing, and the property sector, have not formally been removed. Thus, they may continue deterring credit supply. Third, although a more dovish Fed has provided China with some breathing room to reflate its domestic economy, an overly expansionary credit boom that leads to a rapid upsurge in commodity or asset prices would still put the renminbi under severe depreciation pressures.

7. Nevertheless, the effective easing of financial conditions is an important and necessary step to lift China from the negative feedback loop of below potential growth -> deflation -> worsening NPLs. The sustainability of the recovery over the medium term hinges on whether China can make material progress on many badly needed efficiency-enhancing structural reforms, particularly those related to improving the functionality of its capital markets so as to allocate its massive savings more efficiently. A stable growth and inflation macro environment is certainly more conducive to undertake these reform efforts than a contractionary economic setting. With an already stretched balance sheet and still facing a challenging external environment, China should take the opportunity of a stabilizing macro environment and act decisively to implement the reform agenda it laid out more than 5 years ago at the Third Plenary Session of the 18th Party Congress.

For more details, please see our report entitled Early signs of reflation in China published in February 2019.